the scam of credit cards

17 Oct 2017so maybe i’m thinking about this all wrong, but last month i had a real visceral experience with the scam of credit. i’ve known/felt ever since i was little that the concept of credit didn’t really make sense (back when i learned about the sin of usury (like the original definition of usury) in like sunday school), but back in sept i had a real experience of the twistedness of the system. and i say that not having done anything wrong. here are the pieces that i saw.

the last time i checked my credit score it was at 780. i have a lot of privileges that make that possible.

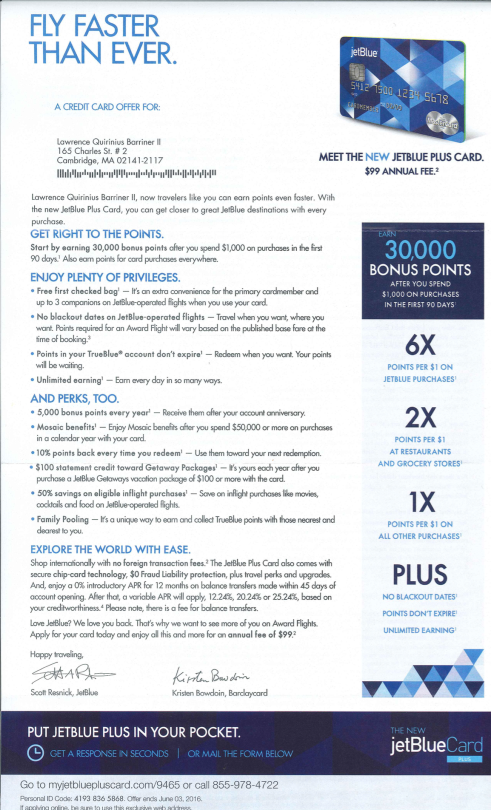

i got a jetblue credit a little over a year ago because it had a 0% apr, gave me excellent bonuses, and had no annual fee.

thanks to don wei for making me sign up when the points were still at this multipler. they have since gone done to 3x maximum.

i used that card regularly and paid down the balance every month. i just wanted the points and to build my credit.

then, i learned (from within the barclay credit card app) that your credit score goes up more if you’re using about 1/3 of it every month. in fact, your score can actually go down if you’re not using enough credit.

the card started out with a $10k limit. i felt comfortable getting it up to 3k and paying off the previous month balance before it accrued interest. so i did that for a while. points still rolling in, still no interest payments.

at some point after the 1year mark several things happened. first, jetblue/barclay sent this really exciting notice that my credit was so good that they bumped up my credit limit… to $16k. i was pumped because WOW; that’s a lot of money to have access to, right?

then card’s annual fee kicked in: $99/year. i thought, well, paying 100$/year to have such a good credit score and access to that much credit isn’t that much money.

then, my apr kicked in: %21. at that point i was pissed.

so now, to keep my score up i need to be rolling with 1/3 of $16,000 (which is ~$5,500) and i have to pay down the entire previousm month balance in order to not pay interest. well, i definitely can’t make payments like that so i’m paying interest now. like $60/month. and on top of the annual fee, that’s like $800/year. at this point, none of this seems worth it anymore. i’m not tryna pay almost $1000/year to have good credit. that seems absurd to me and like a full-on scam.

of course, it’s possible that maybe i’m missing something from the bigger picture. but a question that someone asked on an episode of death, sex, and money about student debt() has really stuck with me: “does anyone else think it’s crazy that it has just been normalized that we’re just supposed to go through our entire adult lives saddled with debt? whether it’s college or a home mortgage or business debt or credit cards, it just seems like to do anything adults do you’re just supposed to have debt. that seems fucking weird.”

and i agree.

words / writing / post-processing

540w / 15min / 8min